Pag-IBIG Financing

The Pag-IBIG housing loan may be used to finance any of the following:

- Purchase of a fully developed lot

- Purchase of a residential house and lot, townhouse or condominium unit

- Construction or completion of a residential unit on a lot owned by the member

- Purchase of a lot and construction of a residential unit thereon

- Home improvement

- Refinancing of an existing loan

- Combination of loan purposes

- Purchase of lot and construction at a residential unit thereon

- Purchase of a residential unit, with home improvement

- Refinancing of an existing mortgage with home improvement

- Refinancing of an existing mortgage, specifically a lot loan, with construction of a residential unit thereon

Borrower Eligibility

- Pag-IBIG I and Fag-IBIG II Program

- Member for at least 24 months at the time of loan application

- Pag-IBIG Overseas Program (POP)

- Member for at least 24 months at the time of loan application

- Not more than 70 years old at loan maturity and must be insurable

- Has the legal capacity to acquire and encumber real property

- Has passed satisfactory background/credit and employment/business checks

- Has no outstanding Pag-IBIG housing loan

- Has no outstanding Pag-IBIG multipurpose loan in arrears at the time of loan application

- Had no Pag-IBIG housing loan that was foreclosed, cancelled, bought back, or subjected to dacion en pago.

Loan Amount

Maximum of P2M, which shall be based on the lowest of the following:

- Capacity to pay (40% of Net Disposable Income)

- The Member's actual need

- His loan entitlement based on member contribution

- Loan-to-collateral ratio

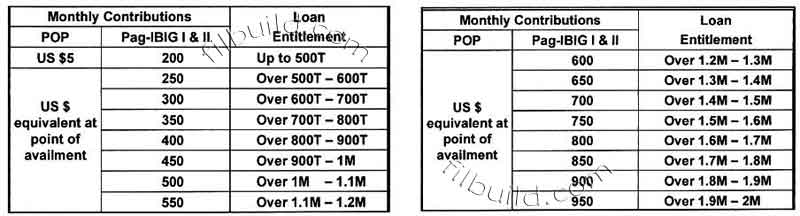

Loan Entitlement Based on Pag-Ibig Contributions

Loan Entitlement Based on Capacity to Pay

Shall be limited to an amount for which the monthly amortization shall not exceed 40% of the member's Net Disposable Income (NDI).

Tacking Provision

Maximum of three (3) qualified Pag-Ibig members who are related within the first civil degree of consanguinity or affinity. Ex:

- Married - spouse, parents/parents-in-law, children

- Single - parents

Interest Rate

| Loan Package | Interest Rate |

| Up to 300T | 6% |

| Over 300T - 750T | 7% |

| Over 750T - 2M | 10.5% |

Repricing

| Loan Package | Interest Rate |

| Over 300T - 750T | 9% |

| Over 750T - 2M | 12.5% |

- For loans up to P300K Pag-IBIG Fund may reprice the interest rate every 3yrs provided that it shall not exceed the original rate.

- For loans over P300K up to 2M, Pag-IBIG Fund shall reprice the interest rate of the loans every three (3) years at the rates based on prevailing market rates at point of repricing, which shall not be lower than the original rates.

Loan Term

Membership Program Pag-IBIG I, II & POP

| Loan Bracket | Term |

| Up to 2M | Maximum of 30 years |

- Shall not exceed the difference between the principal borrower's age at the time of loan application and age seventy (70).

- Borrower shall be allowed to lengthen or shorten the loan term only once during the life of the loan.

Insurance

Mortgage Redemption Insurance (MRI)

- Interim Coverage - based from the issuance of Notice of Approval (NOA) or Letter of Guaranty (LOG) by HDMF.

- Regular Coverage - effective on the date of loan take out.

Fire and Allied Perils Insurance

- Covers the amount equivalent to the appraised value of the residential unit or the loan amount, whichever is lower.

Second Availment

A Pag-IBIG member may avail himself of a second Pag-IBIG housing loan provided he has fully paid his first housing loan, whether as a principal borrower or as a co-borrower.

Additional Loan

A qualified Pag-IBIG member who has an existing housing loan may avail himself of an additional housing loan for the following purposes:

- House construction or improvement of a house constructed on a lot purchased through a

Pag-IBIG housing loan. - Home improvement, under the terms and conditions of the Good Payor Home Improvement Loan Program.

Loan Charges

- Processing Fee - P3,000

- P1,000 - upon filing of HLA, non-refundable

- P2,000 - upon loan take-out

- One year Pre-payment Insurance - to be deducted from the loan proceeds

- Interim Mortgage Redemption Insurance - to be deducted from the loan proceeds (6 mos.)

- One (1) month advanced monthly amortization (without buyback or Window 2 & Retail Acct)

- Retention Fee (CTS) is the amount retained to cover the transfer of TCT under the borrower's name:

- 5.0% - for loans up to 180T

- 6.0% - for loans over 180T to 500T

- 7.0% - for loans over 500T to 1M

- 7.5% - for loans over 1M to 2M

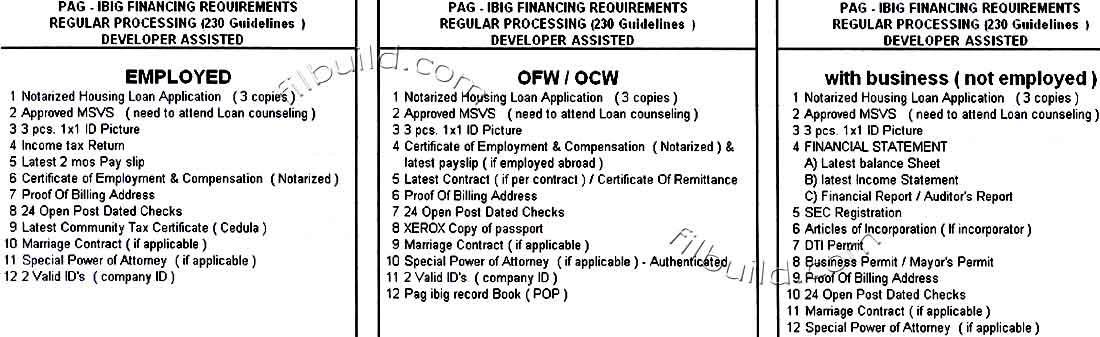

Pag-IBIG Financing Requirements

back to Real Estate Philippines - Condominiums home page