Financing

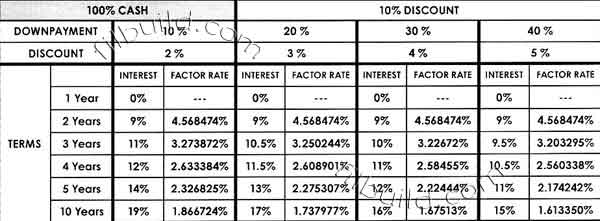

In-house Financing

Note: For DP more than 40%, the applicable discount and factor rates shall be based on 40% DP also.

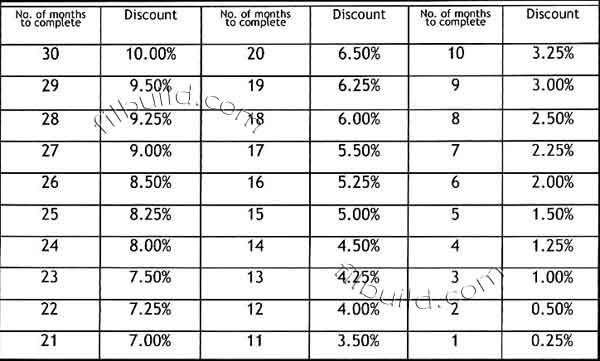

Additional Discount for Spot Cash Payment During Construction Period

For projects with more than 30 months construction period, applicable discount shall be maximum of 10%. These are only applicable to any spot cash payments during construction period. In the case of spot downpayment or partial cash payments, additional discount will be applied on the cash portion only.

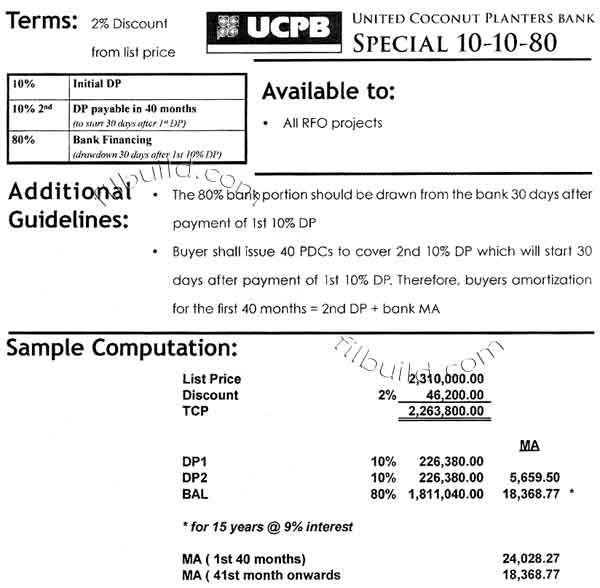

Direct Bank Financing

- Applicable to Accredited Banks only

- If thru NON Accredited Banks - should avail of In-house Financing up to loan drawdown

Accredited Banks

- United Coconut Planters Bank

- BDO/EPCIB

- Union Bank/IBank

- BPI Family Savings Bank

General Terms

- Maximum Loan Amount = 80% of TCP (depending on the result of Credit Investigation)

- Availability of Title & TD = available

- Condominium = RFO

- House and Lot = 100% completed

- Equity = fully paid

Addendum to CTS

- For direct bank financing, buyer shall sign additional document/undertaking which shall form part of the Contract to Sell

- Undertaking states that buyer shall automatically convert to In-house financing in the following instances:

- Disapproval by the bank

- Delay in processing of documents/loan drawdown caused by the buyer

Transfer Fees

- Should be collected prior to loan release

- DMCI will process the Title Transfer. Client does NOT have the option to process Title Transfer

- Details & Computations are as follows:

- Documentary Stamp Tax (DST) - payments made to Bureau of Internal revenue (1.5% of TCP or Zonal Value whichever is higher)

- Transfer Fees - taxes paid to City Treasurer's Office (0.5%)

- Registration Fees - dues paid to the Registry of Deeds (RD)

- Assurance Fund - 1/4% of 1% required by law for every transferred title

- Processing Fees - miscellaneous; e.i., notarial fees, administrative fees, etc.

- Real Property tax - billed upon acceptance of the unit

Regular Bank Financing

Available to

- All Ready For Occupancy (RFO) projects

- Non-RFO medium-rise projects

Accredited Banks

- United Coconut Planters Bank

- BDO/EPCIB

- Union Bank/IBank

- BPI Family Savings Bank

Discount Rates

| 10% DP, 90% BF | 2% |

| 20% DP, 80% BF | 3% |

| 30% DP, 70% BF | 4% |

| 40% DP, 60% BF | 5% |

Sample Computation

Bank Financing For High Rise Condominium

Available to

- All High Rise projects

Accredited Banks

- United Coconut Planters Bank

- BPI Family Savings Bank

Discount Rates

| 10% DP, 90% BF | 2% |

| 20% DP, 80% BF | 3% |

| 30% DP, 70% BF | 4% |

| 40% DP, 60% BF | 5% |

9 Easy Steps To Own A Home Thru Bank Financing

- Inquire from Legal Dept if title and tax declaration of the property intended to be bank financed is available.

- Client to choose a bank from the list of accredited banks.

- Get an application form and list of requirements from clients preferred bank.

- Client to fill out the application form.

- Compile the requirements required by client's preferred bank.

- Submit the duly accomplished Loan Application Form together with the complete documents to Finance Dept.

- Await notificaflon of loan approval. Normally, this takes five (5) to seven (7) working days.

- Developer/Seller shall forward to the bank the duly signed LOG & Deed of Undertaking (DOU) accompanied by Buyers latest Statement of Account.

- Wait for the release of loan proceeds, normally within 7 to 10 working days (drawdown).

Additional Guidelines

- Bank shall conduct pre-evaluation/pre-qualification (30 days from reservation).

- Subject to Final Evaluation wherein Buyer shall be required to submit updated bank requirements at least 4 months prior to RFO date.

- UCPB: drawdown upon completion/RFO date.

- BPI: buyer has the option to draw bank portion during the construction period/Non-RFO stage (Buyer needs to fully pay equity prior to loan drawdown. Additional discount will be applied using SPOT CASH discount rates.

Requirements

Personal Data & Income

If Employed (within the Philippines)

- Certificate of Employment (COE) indicating annual salary and position

- Latest Income Tax Return (ITR)

- Pay slips (last 2 months)

- Proof of Billing Address (Meralco, credit card, etc.)

If Overseas Filipino Worker (OFW)

- POEA authenticated contract (seaman)

- COE authenticated by Philippine Consulate (direct-hired)

If Self-Employed

- Business Name (DTI or SEC Registration)

- Articles of Incorporation and By-laws with SEC Registration Certificates

- List of Trade References (at least 3 names & telephone numbers of major suppliers/customers)

- Audited Financial Statements for the past two years

- Bank Statement for the last six months

- Proof of Billing address (Meralco, credit card, etc.)

If Practicing Doctor

- Clinic address/es and schedule

- Bank Statement for the last six months

If income is from Rental or Properties

- List of tenants and rental amounts

- Complete address/es of properties being rented

- Bank Statement for the last six months

Developer's Requirements

- Issue post dated checks (PDC) payable to the Developer to cover down payment/equity portion

- Settle unpaid equities

- Settle transfer fees to the Developer/Seller

- Sign Contract to Sell/Deed of Sale

Bank Requirements

- Client to express conformity to the Letter of Guarantee (LOG)

- Client to sign the loan documents (Deed of Assignment, Promissory Note, Real Estate Mortgage, Special Power if Attorney, etc.)

- Submit the post-approval requirements of preferred bank, such as

- Post-dated checks

- Mortgage Redemption Insurance (MRI)

- Insurance of the property to be financed

- For Condominiums - Fire/Earthquake Insurance endorsement, Policy & Photocopy of the Official Receipt can be obtained from the Office of the Property Manager

- For Completed House and Lot, Townhouse - insurance should be obtained from a reputable/accredited insurance company

Collateral

Clear photocopy sets of Transfer Certificate of Title (including blank pages with the book and page/volume number indicated on the front page)

For Condominium

- Photocopy of Condominium Certificate of Title (CCT)

- Certificate of Consent and Updated payment of Monthly Dues from Condo Corp.

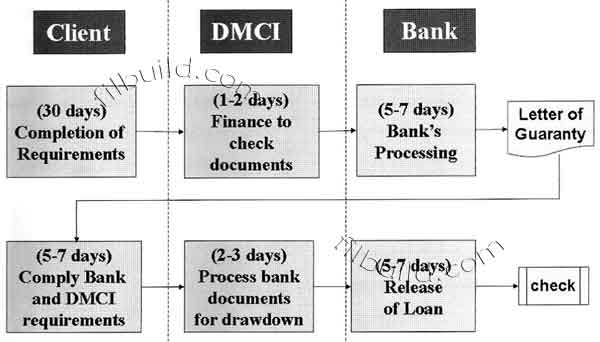

Bank Financing Cycle

Reminders

- Documents should be submitted to Finance Department within thirty 30 days from reservation date. Failure to submit on time shall automatically convert the account to In-House financing.

- Target drawdown date is within 60 days from reservation date or 30 days after full payment of required DP.

- Turnover of unit shall be after loan drawdown.

Bank Financing Process

- The process starts with the client's intent to finance his/her outstanding loan with DMCI thru the bank.

- The client prepares the necessary documents for submission to bank.

- The bank performs the necessary credit investigations & background checks & documentation.

- The bank then approves the loan.

- The bank issues a letter of guarantee & deed of undertaking.

- Finance assistant reviews the documentation and clarifies with the client issues regarding his account.

- Finance assistant endorses the documents to the Department Head for final review and signing; then forwards the document to the authorized signatories to sign signifying DMCI's conforme.

- Authorized signatory signs the LOG & DOU.

- Reproduction of the LOG and DOU.

- A copy of the LOG and DOU is placed on file.

- Another copy of the LOG and DOU shall be forwarded to DOCS CONTROL group for preparation of DOAS.

- Collate the documents.

- Prepare documents for transmittal to Bank.

- Bank processing.

- Determine if accredited bank or if documents can be undertaken.

- If not an accredited bank, Finance Assistant shall wait for the compliance of Legal Department and then the Bank releases the proceeds of the loan.

- If accredited Bank, bank will immediately release proceeds of the loan subject to an undertaking. Compliance by Legal Department.

- Endorse the account (after drawdown) to Billing and Collection for Final Billing.

Pag-IBIG Financing

The Pag-IBIG housing loan may be used to finance any of the following:

- Purchase of a fully developed lot

- Purchase of a residential house and lot, townhouse or condominium unit

- Construction or completion of a residential unit on a lot owned by the member

- Purchase of a lot and construction of a residential unit thereon

- Home improvement

- Refinancing of an existing loan

- Combination of loan purposes

- Purchase of lot and construction at a residential unit thereon

- Purchase of a residential unit, with home improvement

- Refinancing of an existing mortgage with home improvement

- Refinancing of an existing mortgage, specifically a lot loan, with construction of a residential unit thereon

Borrower Eligibility

- Pag-IBIG I and Fag-IBIG II Program

- Member for at least 24 months at the time of loan application

- Pag-IBIG Overseas Program (POP)

- Member for at least 24 months at the time of loan application

- Not more than 70 years old at loan maturity and must be insurable

- Has the legal capacity to acquire and encumber real property

- Has passed satisfactory background/credit and employment/business checks

- Has no outstanding Pag-IBIG housing loan

- Has no outstanding Pag-IBIG multipurpose loan in arrears at the time of loan application

- Had no Pag-IBIG housing loan that was foreclosed, cancelled, bought back, or subjected to dacion en pago.

Loan Amount

Maximum of P2M, which shall be based on the lowest of the following:

- Capacity to pay (40% of Net Disposable Income)

- The Member's actual need

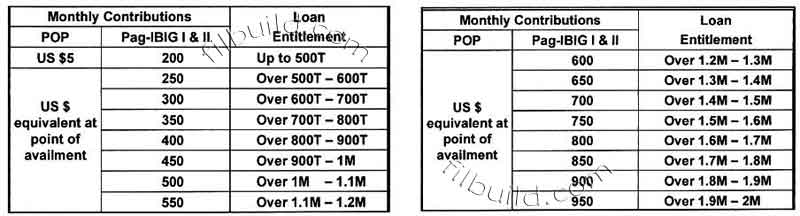

- His loan entitlement based on member contribution

- Loan-to-collateral ratio

Loan Entitlement Based on Pag-Ibig Contributions

Loan Entitlement Based on Capacity to Pay

Shall be limited to an amount for which the monthly amortization shall not exceed 40% of the member's Net Disposable Income (NDI).

Tacking Provision

Maximum of three (3) qualified Pag-Ibig members who are related within the first civil degree of consanguinity or affinity. Ex:

- Married - spouse, parents/parents-in-law, children

- Single - parents

Interest Rate

| Loan Package | Interest Rate |

| Up to 300T | 6% |

| Over 300T - 750T | 7% |

| Over 750T - 2M | 10.5% |

Repricing

| Loan Package | Interest Rate |

| Over 300T - 750T | 9% |

| Over 750T - 2M | 12.5% |

- For loans up to P300K Pag-IBIG Fund may reprice the interest rate every 3yrs provided that it shall not exceed the original rate.

- For loans over P300K up to 2M, Pag-IBIG Fund shall reprice the interest rate of the loans every three (3) years at the rates based on prevailing market rates at point of repricing, which shall not be lower than the original rates.

Loan Term

Membership Program Pag-IBIG I, II & POP

| Loan Bracket | Term |

| Up to 2M | Maximum of 30 years |

- Shall not exceed the difference between the principal borrower's age at the time of loan application and age seventy (70).

- Borrower shall be allowed to lengthen or shorten the loan term only once during the life of the loan.

Insurance

Mortgage Redemption Insurance (MRI)

- Interim Coverage - based from the issuance of Notice of Approval (NOA) or Letter of Guaranty (LOG) by HDMF.

- Regular Coverage - effective on the date of loan take out.

Fire and Allied Perils Insurance

- Covers the amount equivalent to the appraised value of the residential unit or the loan amount, whichever is lower.

Second Availment

A Pag-IBIG member may avail himself of a second Pag-IBIG housing loan provided he has fully paid his first housing loan, whether as a principal borrower or as a co-borrower.

Additional Loan

A qualified Pag-IBIG member who has an existing housing loan may avail himself of an additional housing loan for the following purposes:

- House construction or improvement of a house constructed on a lot purchased through a

Pag-IBIG housing loan. - Home improvement, under the terms and conditions of the Good Payor Home Improvement Loan Program.

Loan Charges

- Processing Fee - P3,000

- P1,000 - upon filing of HLA, non-refundable

- P2,000 - upon loan take-out

- One year Pre-payment Insurance - to be deducted from the loan proceeds

- Interim Mortgage Redemption Insurance - to be deducted from the loan proceeds (6 mos.)

- One (1) month advanced monthly amortization (without buyback or Window 2 & Retail Acct)

- Retention Fee (CTS) is the amount retained to cover the transfer of TCT under the borrower's name:

- 5.0% - for loans up to 180T

- 6.0% - for loans over 180T to 500T

- 7.0% - for loans over 500T to 1M

- 7.5% - for loans over 1M to 2M

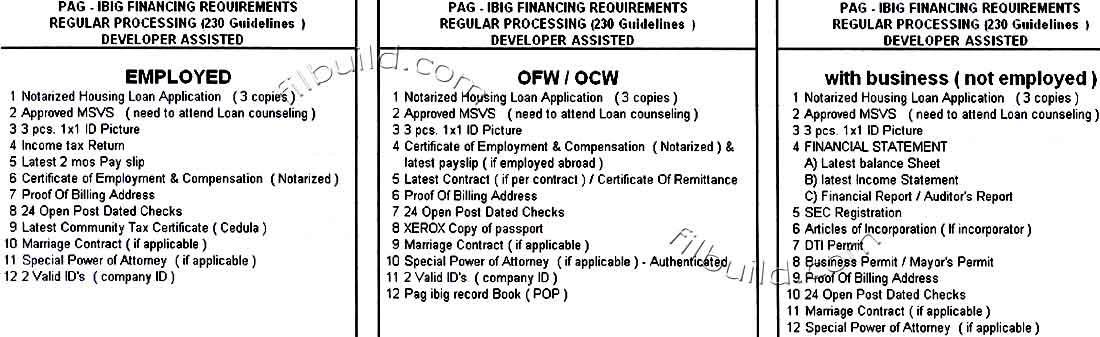

Pag-IBIG Financing Requirements

back to Real Estate Philippines - Condominiums home page